Dec 19th 2011

Money Mourning or The Emperor’s New Clothes

Backgrounds why any currency system MUST fail and inevitably end in a hyper inflation!

What exactly is a currency, so for example Euro, Dollar, Yen or Pounds?

Well, nothing more than, by the editor rights, within a specific dissemination area, with a symbol as an identification mark provided IOUs (promissory note, abbreviated from the phrase "I owe you").

The whole thing we call "paper money" because it represents a claim painted on paper, just "money".

On what is based the value of money?

Simply on trust! The confidence that we receive an, from the "editor" of the "money" with a real counter "value" eg a product or service plus an included, "added value" in whom we believe.

How strong is the value of money?

Well, just always as strong as our simple trust is, in the later reception of a "value".

Remember this good, because it is important knowledge that we will later need!

Our economic- and thus currency systems are based on growth. Growth which, based on the compound interest effect, is and must be aligned exponentially. Exponential growth is already a size which does not occur in nature, because it doesn’t work!

Because it doesn’t work in nature, so it doesn’t work in artificial systems. But even if assumed the artificial (man-made) system "currency" would work, again the collapse is inevitable. Because an infinite growth doesn’t and cannot exist! Also this proves, once again by any growth and decay, nature.

Conclusion: At some point of any growth follows the collapse imperative.

The compound interest effect leads inevitably to the collapse. The following example shows an economy takes the sum of 1 on debt/loan at 3% interest rate. Then from the 25th year they must already pay 1.033 in interest. After one hundred years, already almost “20” on interest needs to be paid. ([Cn = C0 (1+p/100)n] = Cn final capital, C0 = initial capital, p = rate of return (interest rate, in percent), n = number of the applicable time periods / years)

At some point "x" must already be paid more in interests than the actual debt is. But Interests can only be financed by debts, because they artificially generate just a virtual value, and therefore firstly are not at present in the monetary system.

Because higher debt must always be taken to serve ever higher interest rates, the debt ratio increases exponentially due to the compounding effect.

Conclusion: Even and especially in this case follows at a certain point of collapse.

Of course, if in addition to the interests also the amount of what was the basically debt would regularly become reduced (pay off), at some point debt and interest rates went to zero.

Only, in our economies a pay-off is not possible!

Why?

Because of our economic systems are designed for growth. Growth because more and more people will or must, live on ever better standards (prosperity). And growth itself can be financed by debt ONLY.

Our monetary and economic systems are forced into a debt financing system!

Because interest rates and growth can be financed, system-related, exclusively by debt!

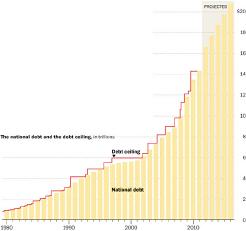

Here is an illustration of the debt evolution, eg in Germany and the U.S.

|

|

| Source: Fed. Ministry of Finance - Germany | Source: US-American Centralbank FED - St. Louis |

At one example each, I want to show you why.

The debt financing of growth:

So we construct a system in which all the money in the world is 10,000 and all the participants there are 10. The goal is to keep the system alive thus to save it from collapse. An "editor" (e.g., via a state) is a bank (World Bank, Central Bank, State-, Commercial- or Savings Bank), distributes the 10,000, as a loan of 1,000 evenly to each player, into play (because commonly known: “money does not grow on trees”). We begin with an even cash distribution for all participants to grant equal opportunities.

The 10 players ("A" - "J") will now generate revenue, thus achieving growth. Hence "A" provides whatever to "B" and therefore puts a bill of 2,000. "B" does as well and creates a bill to "C" of 3,000. "C" then places a bill of 4,000 "D", a.s.o. At last "I" puts a bill of 10,000 to "J. Once the year is over, all now return their debts of 1,000 to the bank.

Because "J" but must pay 10,000 to "I", he must get the 10,000 as an additional debt. Even though he only gets back to zero (for which he in turn must pay interests).

To lend these 10,000 plus interests, and just to even the system back to zero, the bank now also must add 10,000 plus interest as new debt. To compensate for his debts in the following year "J" puts a bill of 12,000 to "A", a.s.o. (Of course in turn, as well all interests can only be financed by debts).

Conclusion: Growth can be financed only by debt. Steady growth and leads inevitably and perpetually to an ever higher debt. It follows a steadily higher money supply, which leads to a steadily rising inflation. This from some point, vanish confidence in the system that thus results in a collapse.

The debt financing of Interests:The same game as before, only now with the fact that the players, who in turn borrow each a 1,000 from the bank, work equally well and therefore earn back only the 1,000 on loan.

But of course the bank will charge interest for it, let’s say 10%. After one year, the players should give back the 1000 plus 10% interest comes to 1,100. Thus in such out of a stock of 10,000 the bank constructed a claim (= value of stock) of 11,000.

How is possible? Actually not, because these 10 x 100 in interests, did not exist in inventory so. They therefore consist of NOTHING, initially are only a "virtual value"!

Anyway to give additionally this 10 x 100 to the bank, they therefore have to borrow it as additional debt. Where? Of course, at the bank, which in order to be able to lend the additional 1,000, for their part must borrow accordingly.

A debt of which the bank pays interests too! To compensate this new debt on loan and interests, the bank now either has to lend higher loans or charge higher interest rates. Hence the players necessarily must take higher debs. For these higher debts, interests will be higher too, which in turn can ONLY be offset by higher debt levels, and again and again.

Conclusion: Growth and interests can be financed by debt only, because initially they are not included in the monetary system. The debt is therefore growing inevitably and incessantly, and as aforesaid, growth and interests leads the system to collapse.Here is an illustration of the development in interest expense for example, in Germany and the U.S.

|

Year |

Interest expense of Germany in Billion Euro |

Interest expense of USA in Billion US$ |

| 2011 | 62,0 | 454,4 |

| 2005 | 64,2 | 352,4 |

| 2002 | 66,3 | 332,5 |

| 2000 | 67,8 | 362,0 |

| 1995 | 66,2 | 332,4 |

| 1990 | 33,5 | 264,9 |

| 1985 | 28,7 | |

| 1980 | 15,0 | |

| 1975 | 7,6 | |

| 1970 | 3,6 | |

| 1960 | 0,8 | |

| Source: Fed. Dept. of StatisticGermany 31.1.11 | Source: US-Dept. of Treasury |

So far we’ve investigated ONLY the economic and monetary systems of the real economy. These collapse scenarios could be countered even, that growth generated from the population explosion and the development of "developing" and "emerging markets" as well as the modernization of the industrial countries. Let us keep aside the fact that even these circumstances could only delay the collapse but not stop it. Since these growth resources are basically limited on the one hand, and on the other hand, the population increase takes place mainly in developing and emerging countries where their purchase power generally tends to zero, while in developed countries it’s declining already.

The immediate driver for the imminent collapse of the real-economy and its monetary system, however, lie in the virtual systems of the "(capital) market"!

These virtual currency systems expand, with additional promissory notes (IOU’s), such as e.g. Stocks, Options, Bonds, Derivatives and Account-Statements, ranging to absolute perversion.

Examples (simplified interpretation waiving completeness or special constructs):

Stocks as a participation on a company has nominal value of e.g. "5" (intrinsic value) and is supplied with an extrinsic value of e.g. "20". Being circulated, promising an annual distribution of the profit share from the company (dividends). Therein lies the trust (hope or bet) on the highest possible dividends (return on invested capital) and thus also an increased chance of passing on a price higher than the starting price (market value).

Options are under similar conditions as stocks, but have no dividend and no intrinsic value. It represents only a possibility (option) to buy (call) or sell (put) your. Its market value lies in the hope of rising or falling market prices.

Bonds make the promise of repayment e.g. a state on one him borrowed money for a certain time at a regularly interest. It’s a state’s loan, to enable the finance of his growth or debt, in the trust that he pays it back with interests.

Derivatives are bundled debts bonds or “structured finance instruments” eg, other stocks, forfeiting = purchase of receivables under the waiver of recourse against the seller for non-payment) or betting on changing values or market reference variables (eg, certain commodities, indices or interest rates).

Account statements are netted “IOUs” of a bank to a depositor, e.g. from bank accounts or credit card systems. The equally perfidious as perverse thing is, that as cover of the amounts of loans which it lends and therefore needs to indebt itself (reserve requirement), the banks must have actually just a minimal percentage (e.g. ECB = 2%, FED = 10%, Bank of England 0%). For example, per 1,000 the Fed lends, has to have a reserve requirement of only one hundred. The Bank of England, however, needs to hold minimum reserves not at all, but may indebt itself unlimited.

These netted, thus virtually generated demands ("virtual money"), we must compensate by promissory notes from the real economy system that ("real money").

What is the perversion?

In the decoupling of virtual values from real values, i.e. products (food, goods) and services (labor).

With virtual money no real intrinsic value is expected. There is merely speculation on an "interest" held. An interest consisting of the difference between the level of confidence in the passing ability (speculative value) and an even higher level of confidence of another (speculative value)! Or in receipt of an additional promissory note (money) in return! Hence interests are thus no “real values” but only "virtual value", because consists of NOTHING!

“Virtual values” are reproducible unlimited, as no “real values” in such as no materials, labour and / or labour time are compared to.

Real values are, due to material, labour- and / or time needed, always limited and therefore also limit the quantity respectively the amount of debts compared to the titles of debt from "real money". Because an infinite amount of money requires necessarily infinite real values against it. But this is not possible.

Due to the aforementioned conditions, capital market players will allow to borrow ultimately unlimited. Because on unlimited debts, interests are to pay, become these by the compounding effect in turn exponentially high, thus unlimited.

The perversion therein is, that this "virtual value" (interest) through "real money" hence can be compensated in turn by debt only. This firstly drives the debt and thus the money supply to infinity and ends in hyperinflation then collapse.

Logically, however, also for the interests (somewhere, somehow and at some point) real values must be provided. Because liabilities on “real money” are facing “real value”(work) requirements. Thus in our monetary systems, for unlimited money supply, we must provide unlimited real but limited values namely material, labour or time.

And that's simply IMPOSSIBLE and inevitably leads to COLLAPSE!

Herewith, it is proved for several reasons, that at a certain point every currency system must collapse!